Since September 28th, 2023, the State of Montana WOTC Program adjusted the way in which Employers and Employer Representatives e-file WOTC applications. These changes are in place to ensure secure transfer of application materials as we work to update our system to align with new U.S. Department of Labor requirements.

Work Opportunity Tax Credit (WOTC)

Online Application FilingWhat Do You Need to Do?

If submitting a WOTC application after September 28th, 2023, you will need to use the following directions:

-

Date of Hire 9/30/2023 or Earlier

- Download the previous WOTC Application Forms*

Download the IRS 8850 (Pre-Screening Notice & Certification Request) and previous ETA 9061 (Individual Characteristics Form).- FY23 - ETA 9061 (English)

- FY23 - ETA 9061 (en español - Spanish Translation)

-

*If you are not the employer, but are representing the employer, download the ETA 9198 (Employer Representative Declaration)

You may also need to download supplemental forms required for requested target groups:

- Release of Information

- Previous ETA Form 9175 (Self-Attestation Form for Long-Term Unemployed)

- Complete All Application Forms

Complete all required sections of the IRS 8850 & ETA 9061, plus the Release Form and ETA Form 9175 if required. Be sure to provide accurate and up-to-date information. - Gather Supporting Documents:

Collect any supporting documents that are necessary, such as the Release Form , ETA 9198 for Employer Representative (if first time submitting on behalf of an employer), Verification of Name/SSN, or any additional information per application requirements. - Follow the Directions to Submit Your Application Electronically or via Physical Mail:

The State of Montana WOTC Program will have two methods in which applications can be submitted. For directions, please select the method in which you would like to send your application:

- Download the previous WOTC Application Forms*

-

Date of Hire 10/1/2023 or Later

- Download the WOTC Application Forms

Download the IRS 8850 (Pre-Screening Notice & Certification Request) and new ETA 9061 (Individual Characteristics Form).- FY24 - ETA 9061 (English)

-

If you are not the employer, but are representing the employer, download the ETA 9198 (Employer Representative Declaration)

You may also need to download supplemental forms required for requested target groups:

- Release of Information

- New ETA Form 9175 (Self-Attestation Form for Long-Term Unemployed)

- Complete All Application Forms

Complete all required sections of the IRS 8850 & ETA 9061, plus the Release Form and ETA Form 9175 if required. Be sure to provide accurate and up-to-date information. - Gather Supporting Documents:

Collect necessary supporting documents, such as the Release Form, ETA 9198 for Employer Representative, Verification of Name/SSN, or additional information per application requirements. - Follow the Directions to Submit Your Application Electronically or via Physical Mail:

The State of Montana WOTC Program will have two methods by which applications can be submitted. For directions, please navigate to the appropriate section for the method by which you would like to send your WOTC application:

- Download the WOTC Application Forms

-

Submitting Your WOTC Application via Physical Mail

Mail your WOTC application and all required documents to:

WOTC Unit

P.O. Box 1728

Helena, MT 59624-1728-

NOTE:

The physical package must be postmarked no later than 28 days after the Employee’s start date to be considered for tax credit eligibility.

-

-

Submitting Your WOTC Application Online via File Transfer Service (FTS)

Please note that as of September 28th, 2023 –WOTC application forms (IRS 8850, ETA 9061, ETA 9175, ETA 9198, Supporting Documentation) will now be uploaded via the State File Transfer Service. MontanaWorks Business Portal online services will be postponed until otherwise noted.

Use the following instructions to ensure your application material is sent correctly via the new process:

- Save each WOTC Form as PDF using the following file naming format:

-

Applicant Last Name + Employer Name + Application Form

Examples:

- Smith_ABC Company LLC_ETA 9061.pdf

- Miller_XYZ Corp_ReleaseForm.pdf

- Jones_BCD Inc_ETA9175.pdf

-

- Save each individual’s WOTC Application files to a ZIP folder:

-

Note: Please save each application to a separate Zip folder. One Zip folder per application

How to create a ZIP Folder in Windows

Watch on Youtube: Create ZIP Folder on Windows Device

-

Save your WOTC application files to a folder on your Windows device

-

Right select your application folder

-

Hover over “Send To” from the options menu

-

Select “Compressed (zipped) folder” from the available options

-

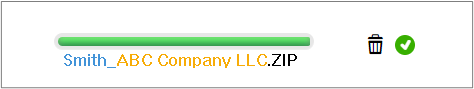

Rename the ZIP Folder in the following format:

Applicant Last Name + Employer NameExample:

Smith_ABC Company LLC.ZIP

-

-

How to create a ZIP Folder in Mac

Watch on Youtube: Create ZIP Folder on Mac Device

-

Locate the file on your Mac device

-

Press and Hold OR right-click on the file/folder

-

Select “Compress “Untitled Folder”

-

Rename the Folder in the following format:

Applicant Last Name + Employer Name

Example:

Smith_ABC Company LLC.ZIP

-

-

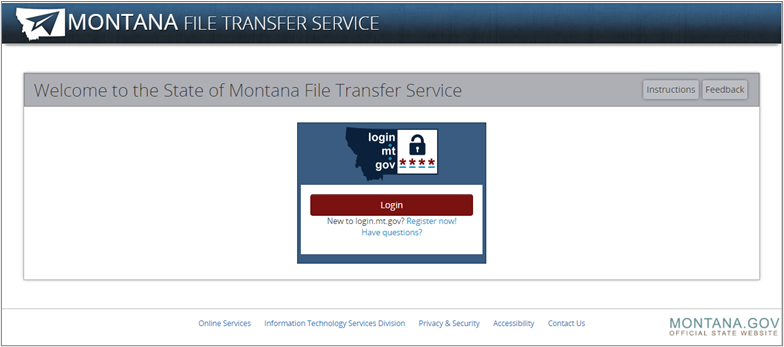

- Navigate to https://transfer.mt.gov/upload?type=WOTC-FY24-Applications

- If you already have an mt.gov online account, select the red Login button to access FTS. Once you login through Okta, you will then be able to access the File Transfer Service (FTS) through the FTS URL.

- If you do not already have a mt.gov online account, select Register now! Once you complete the mt.gov registration process in Okta, you will need to renavigate to https://transfer.mt.gov/upload?type=WOTC-FY24-Applications in order to access the File Transfer Service (FTS) site.

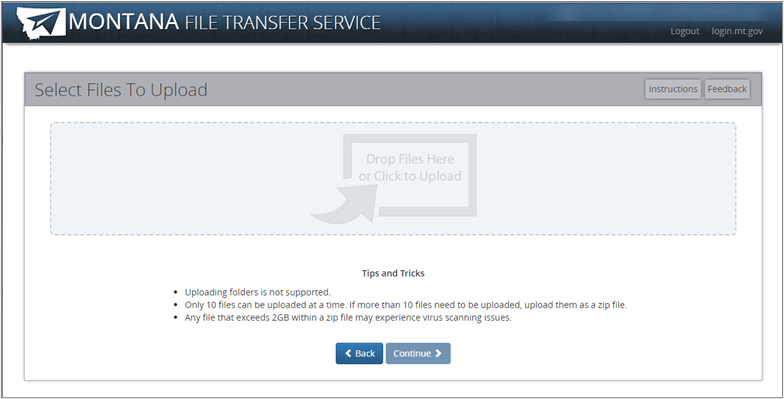

- Upload the Application ZIP Folder to the Drop Files Here or Click to Upload option.

- Notes:

- You can submit up to 10 ZIP Folder applications at a time

- Password Protected Files are not accepted

- Files exceeding 2GB are not accepted

- Folders MUST be compressed ZIP File, standard folders are not accepted. Attempts to upload a standard folder will fail.

- A green checkmark will display when your file is ready to send

- You can submit up to 10 ZIP Folder applications at a time

- Notes:

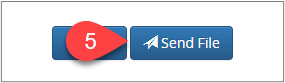

- Select the "Send File" Button

- Select the "Print" button to save a copy of the submission confirmation for your records.

- Note:

The date of file submission (DOS) will be used as the application postmark date for processing purposes. The DOS must be no later than 28 days after the Employee’s start date to be considered for tax credit eligibility.

- Note:

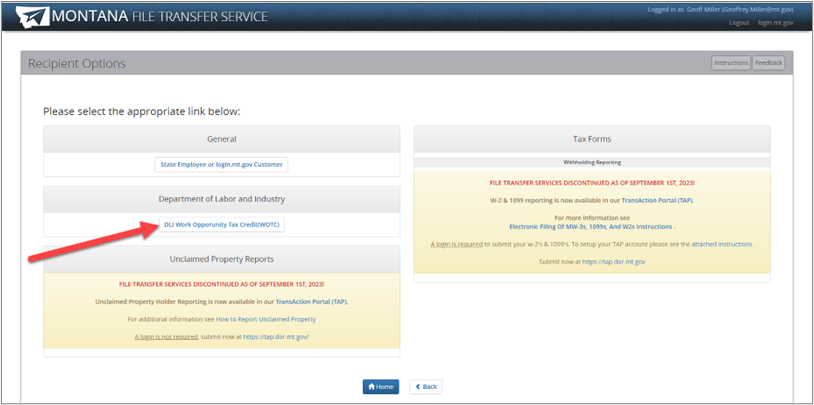

If you are performing a file upload from the Sent Transfers page, you will need to select the “DLI Work Opportunity Tax Credit(WOTC)” option from the Recipient Options Page to send your application material to the correct location.

- Note:

- Save each WOTC Form as PDF using the following file naming format:

-

Things to Know

- For applications submitted with a Hire Date that is after September 30th, 2023; please anticipate delays of at least 60 days as our technical teams work diligently to adjust our e-filing system to the new federal requirements.

- Our office will send processing updates to employers and employer representatives via the email address associated with their MT.GOV account.

- Those Employers & Employer Representatives who submitted WOTC applications via MontanaWorks.gov prior to this change will need to contact our office to obtain necessary documentation. Please see the Contact Us section for more details.

We appreciate your patience as we work through these system updates.

-

Contact Us

If you require additional assistance regarding this information, or need to obtain previously submitted materials, please contact the WOTC Team at wotc@mt.gov. For more information on the WOTC program, go to https://wsd.dli.mt.gov/employers/wotc.

-

Stay Updated

Updates on the resumption of electronic filing will be posted on our website and emailed to existing mt.gov account holders. Thank you again for your understanding and cooperation.